If you're running an online business using Wix, it's essential to understand the fees associated with accepting payments from customers. After all, payment processing fees can take a significant chunk from your profits if you're not careful. Wix Payments is a popular payment gateway that many Wix users utilize to accept credit card payments, Apple Pay, Google Pay, and more. And like all payment gateways, Wix Payments charges various fees for its services.

This post will take a closer look at the fees associated with Wix Payments and help you understand how they can impact your Wix business. It will cover transactions, chargebacks, currency conversion, and the different types of fees that you might pay when using Wix Payments. It will also compare Wix Payments fees with other popular payment gateways to help business owners make informed decisions. By understanding the fees associated with Wix Payments, Wix business owners can make more informed decisions about their pricing strategy, payment methods, and overall business operations.

Wix Payments: Fee Overview

Wix Payments charges a transaction fee for processing payments, which varies depending on your location and the payment methods. In addition to transaction fees, Wix Payments may also charge other fees such as chargeback, currency conversion, and payment provider fees. But Wix Payments does not charge any setup or monthly fees, making it a cost-effective solution for small businesses and startups.

| Types of Fee |

Transaction |

Chargeback | Currency Conversion | Payment Provider | Setup | Monthly |

|---|---|---|---|---|---|---|

|

Price |

2.9% of the transaction value (plus $0.30 for online card payments) |

Around $20.00 (exact fee varies depending on your location) |

Around 2% of the transaction value | Exact fee varies depending on the provider and the payment method used |

None ($0.00) |

None ($0.00) |

Transaction Fee

This is the primary fee associated with Wix Payments, a percentage of the total sale amount that Wix deducts for processing the payment. The exact percentage varies depending on your location and the payment methods used. For example, in the US, the transaction fee is 2.9% of the transaction value plus $0.30 for online card payments. This fee covers the payment processing cost, including fraud detection and prevention, payment authorization, and settlement to your bank account.

| Types of Transaction Fee |

Credit / Debit Card |

Apple Pay | Google Pay | Wix Payments Point Of Sale (POS) | Tap To Pay | Tap To Pay On Mobile | Manual Card Entry | Afterpay | Affirm |

|---|---|---|---|---|---|---|---|---|---|

|

Price |

2.9% of the transaction amount + 0.30 USD | 2.9% of the transaction amount + 0.30 USD | 2.9% of the transaction amount + 0.30 USD | 2.6% of the transaction amount + 0 USD | 2.6%of the transaction amount + 0.20 USD |

2.6% of the transaction amount + 0.20 USD |

3.5% of the transaction amount + 0.30 USD | 6% of the transaction amount + 0.30 USD | 6% of the transaction amount + 0.30 USD |

Chargeback Fee

A chargeback occurs when a customer disputes a charge on their credit card, and the payment processor (in this case, Wix Payments) reverses the transaction. Wix Payments charges a fee for chargebacks to cover the dispute's administrative costs. The exact fee varies depending on your location, but it's typically around $20. This fee is in addition to the loss of revenue from the disputed transaction, so it's important to minimize chargebacks, such as providing clear product descriptions and responding promptly to customer inquiries.

Currency Conversion Fee

If you're selling internationally and your customer pays in a different currency than your own, Wix Payments will convert the payment to your currency. Wix Payments charges a currency conversion fee for this service, typically around 2% of the transaction value. This fee covers the cost of converting the currency and any associated risks, such as fluctuations in exchange rates. To minimize currency conversion fees, you can consider offering prices in the customer's local currency or using a payment gateway that supports multi-currency processing.

Payment Provider Fee

Wix Payments may sometimes use a third-party payment provider to process the payment. If this is the case, the payment provider may charge an additional fee. The exact fee varies depending on the provider and the payment method used. This fee is typically a percentage of the transaction value, and it covers the cost of processing the payment through the provider's network. Choose payment methods like credit card or PayPal to avoid payment provider fees.

Setup Fee

A setup fee is a one-time fee to set up a new account. This fee covers configuring the account, such as setting up payment gateways and integrating with your website. Wix Payments does not charge a setup fee, which makes it a more accessible option for small businesses and startups.

Monthly Fee

A monthly fee is a recurring fee to maintain your account. This fee covers the cost of ongoing services, such as fraud detection and prevention, customer support, and account management. Wix Payments does not charge a monthly fee, which makes it a more cost-effective option for businesses with lower sales volumes.

How to Reduce Wix Payment Fees?

While it's impossible to eliminate Wix Payments fees, there are strategies to reduce them.

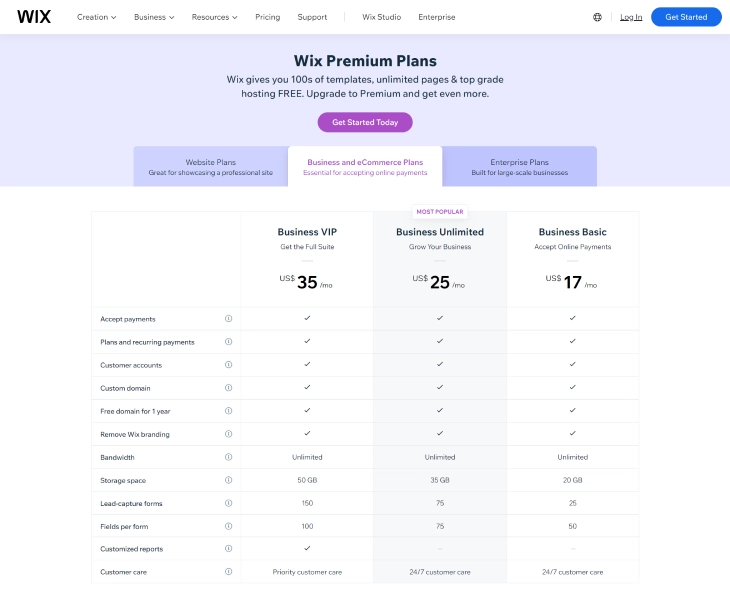

Choose the Right Pricing Plan

Wix offers several pricing plans for its website builder and ecommerce platform, each with different features and transaction fee rates. Choosing the right plan based on your sales volume can help you save on fees. For example, if you have a high sales volume, you may qualify for a lower transaction fee rate by upgrading to a more expensive plan. It's important to carefully review each plan to know the best fit for your business.

Minimize Chargebacks

Chargebacks occur when a customer disputes a charge on their credit card, resulting in a reversal of the transaction and a loss of revenue for the business. In addition to the lost revenue, chargebacks also incur additional fees from the payment processor. Implementing good business practices, such as providing clear product descriptions, responding promptly to customer inquiries, and using fraud detection tools, can help minimize chargebacks and associated costs. It's also important to understand the chargeback policies and procedures to ensure the appropriate steps to resolve disputes.

Consider Currency Conversion

If you're selling internationally, currency conversion fees can add up. Offering prices in the customer's local currency can help reduce currency conversion fees, as the customer's bank will handle the conversion instead of the payment processor. You can also consider using a payment gateway that supports multi-currency processing, which allows you to accept payments in multiple currencies without incurring additional fees. It's important to carefully review currency conversion policies and fees to determine the best approach for your business.

Wix Payment Fees Vs. Other Payment Gateways

When comparing Wix Payment fees to other payment gateways, it's important to consider the specific needs and transaction volume. While Wix Payments offers competitive rates and no monthly or setup fees, other payment gateways like PayPal, Stripe, and Square may offer different features and fee structures that could be more advantageous for certain businesses.

Wix Payments Vs. PayPal

Wix Payments and PayPal charge similar transaction fees, with Wix Payments charging 2.9% + $0.30 per transaction for credit/debit card payments, and PayPal charging 2.9% + $0.30 per transaction for US-based transactions. PayPal also charges a fixed fee per transaction, ranging from $0.30 to $0.49 depending on the transaction amount. This can make Wix Payments a more cost-effective choice for low-value transactions, as the fixed fee can add up quickly.

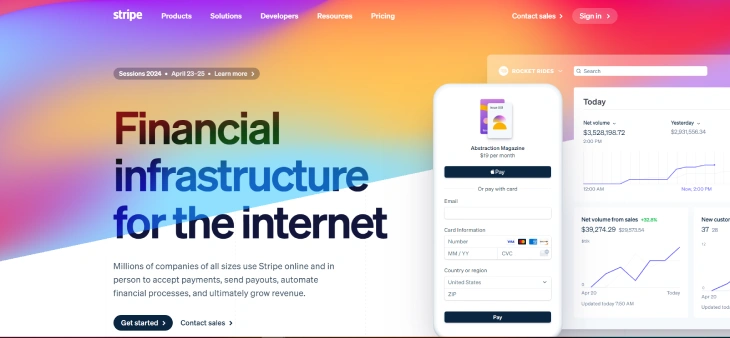

Wix Payments Vs. Stripe

Stripe's fees are generally higher than Wix Payments, with Stripe charging 2.9% + $0.30 per transaction for credit/debit card payments. Stripe offers more advanced features than Wix Payments, such as support for multiple currencies, subscription-based billing, and customized invoicing. These features might justify the extra cost for some businesses.

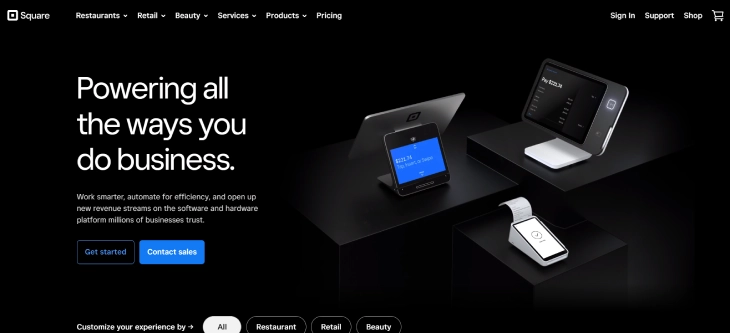

Wix Payments Vs. Square

Square's fees are comparable to Wix Payments, with Square charging 2.6% + $0.10 per transaction for credit/debit card payments. Square is more suited to businesses with a physical presence, as it offers robust POS features such as card readers, receipt printers, and cash drawers. Square also offers features such as inventory management and employee management, which can be useful for businesses with a physical storefront.

Conclusion: Understanding Wix Payments Fees

Understanding the fees associated with Wix Payments is important for any online business owner looking to maximize profits and make informed decisions about their payment processing strategy. While Wix Payments charges various fees, such as transaction fees, chargeback fees, and currency conversion fees, it does not charge any setup or monthly fees, making it a cost-effective solution for small businesses and startups.

By choosing the right pricing plan, minimizing chargebacks, and considering currency conversion, business owners can reduce the fees associated with Wix Payments. It's also important to compare Wix Payments fees with other popular payment gateways to determine which option best suits your business. By taking the time to understand Wix Payments fees and making informed decisions about your payment processing strategy, you can optimize your business operations and increase your profitability.

* read the rest of the post and open up an offer